Defily Lending is now available in the RICE DApp. You can access Defily through RICE Wallet to supply USDO, then borrow BUSD to mint new USDO.

Get the latest version of RICE Wallet to start leveraging your USDO now: ricewallet.io/apps

How to lend and borrow in Defily with RICE Wallet

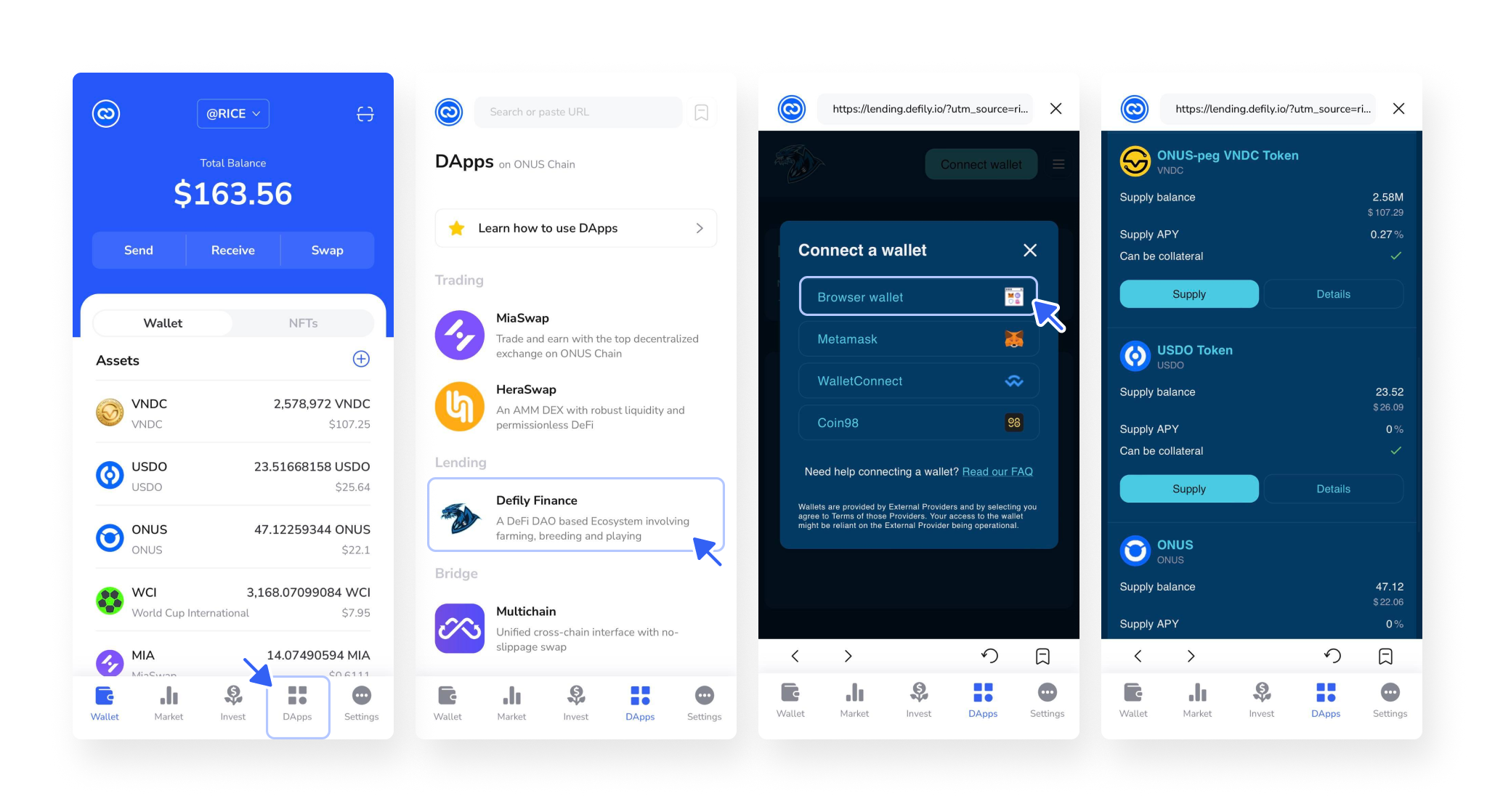

1) Launch RICE Wallet and go to DApp section in ONUS Chain; tap on Defily on the main screen then choose Browser Wallet to connect

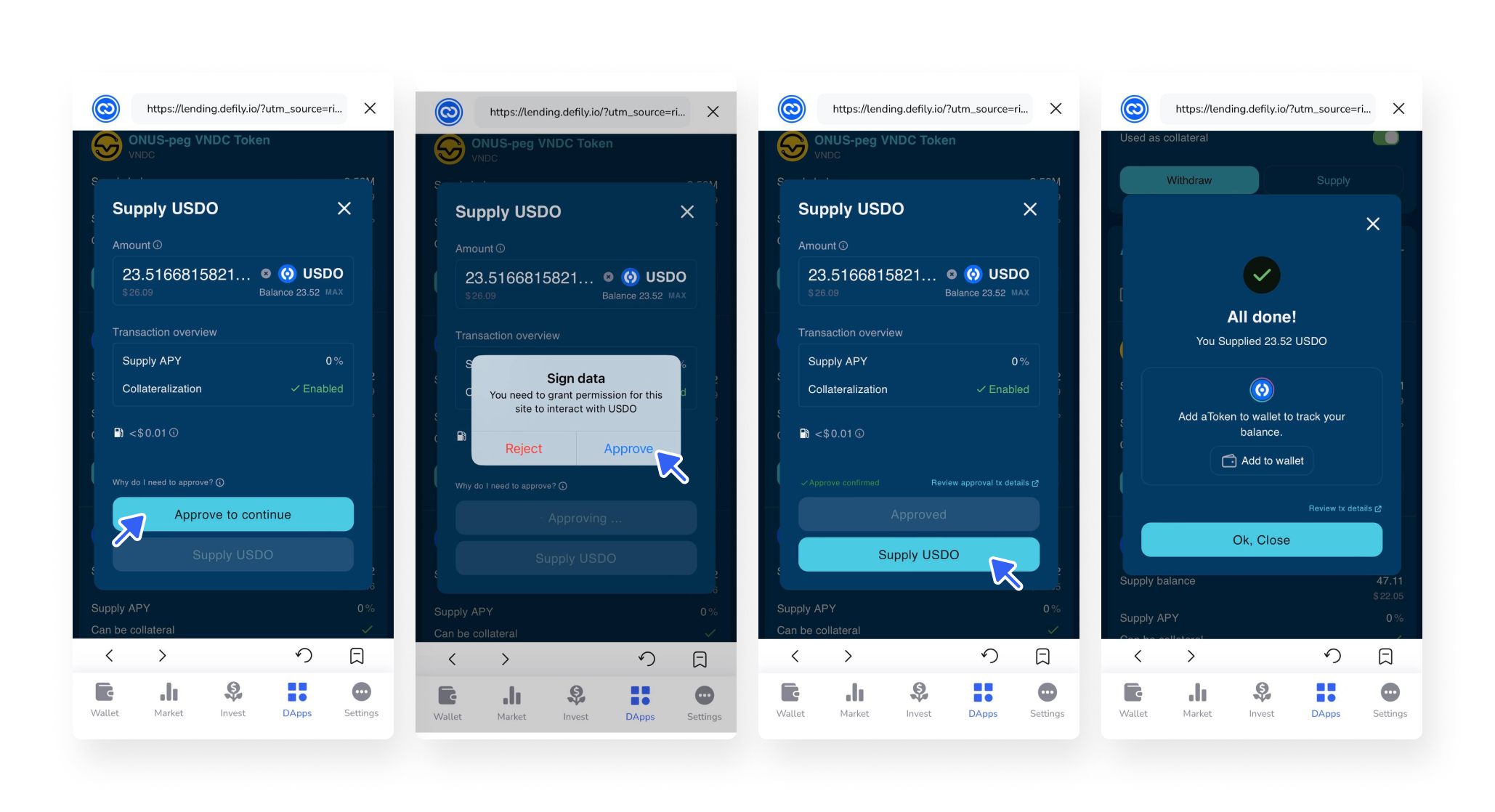

2). In the Supply section, find USDO, then hit the Supply button. Enter the desired amount, approve and confirm the transaction to complete.

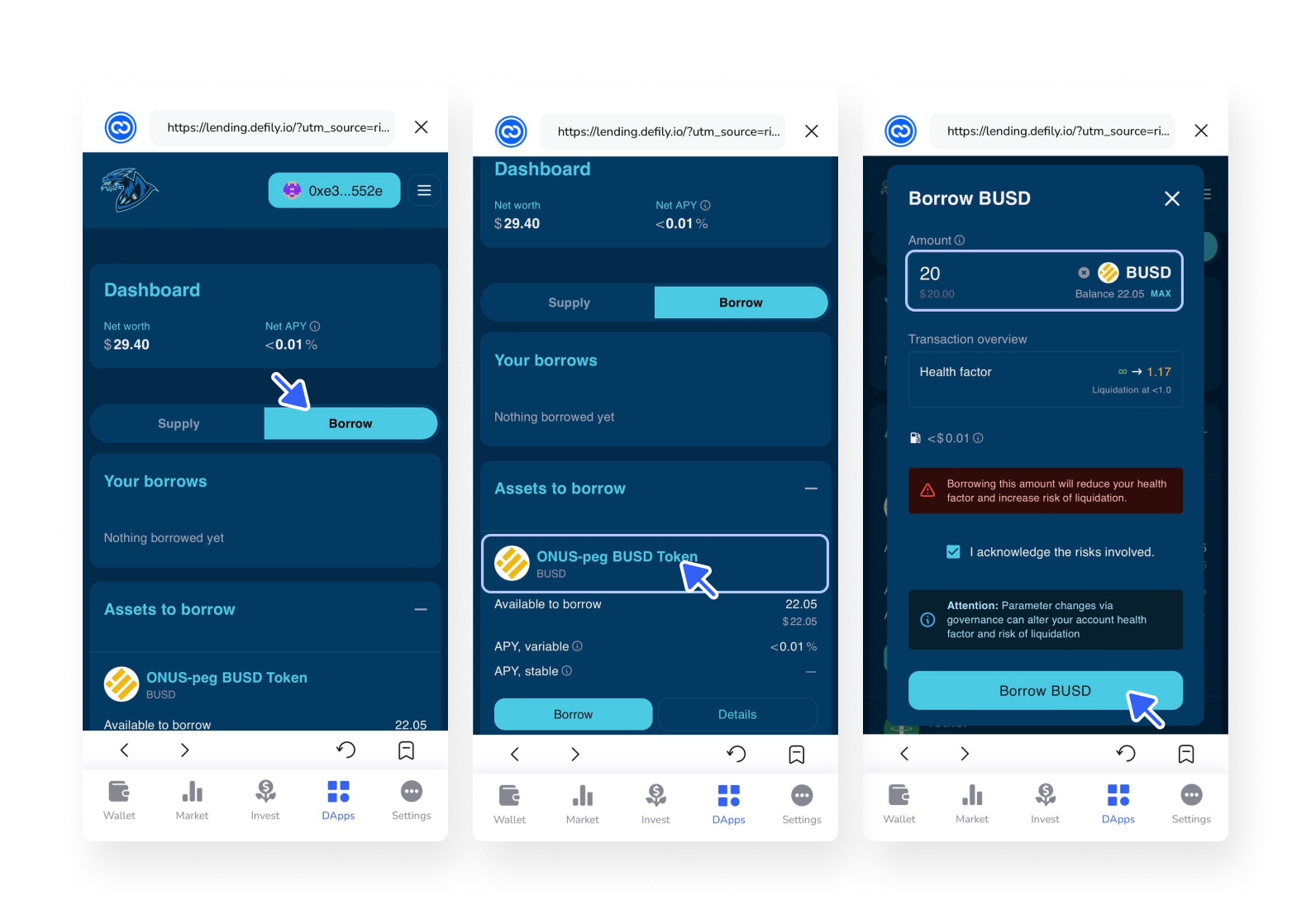

3) Go to the Borrow section and borrow BUSD. Enter the desired amount, tick the warning box then hit the Borrow button.

The maximum amount you can borrow depends on your supply. Your position will be liquidated if your health factor is below 1.0.

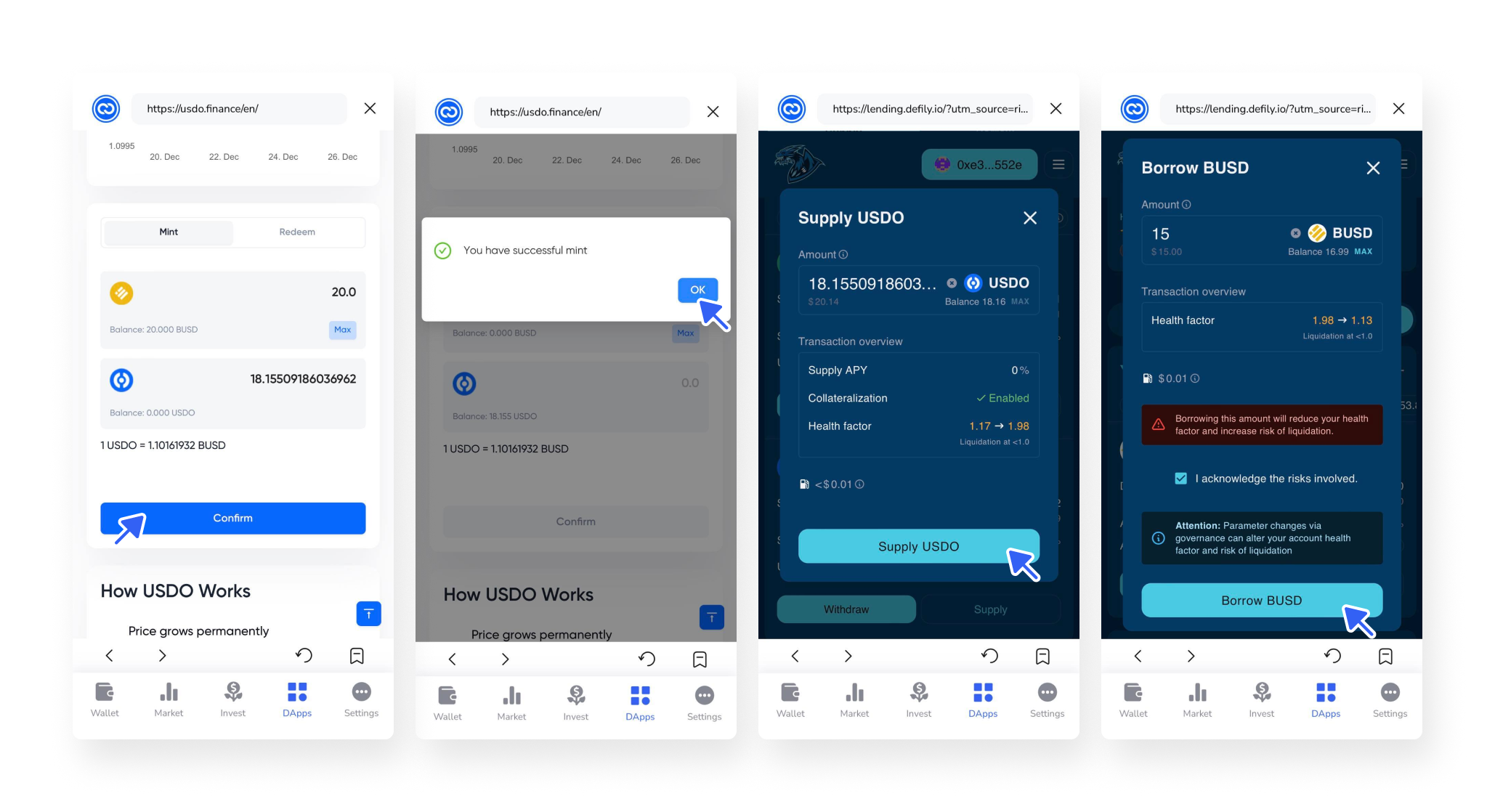

4) Approve and confirm the borrowing transaction. Now you can head to the USDO website to mint new USDO with the borrowed BUSD. Then continue to do the lending/borrowing circle again.

About Defily

Defily Lending is the first Lending/Borrowing protocol in the ONUS Chain ecosystem with a wide range of assets, abundant liquidity, and low costs. Users can supply holding assets to receive rewards or borrow other assets to improve investment ability. The main features of Defily Lending include:

Supplying & Earning

This feature allows users to supply their preferred assets into the protocol, thereby increasing passive income based on the borrowing needs of the market. Each asset will have a different APY and will change over time. Additionally, supplying assets allows users to borrow by using your supplied assets as collateral. Any interest earned by supplying funds helps offset the interest rate that users accumulate by borrowing.

Borrowing

With this feature, users can make loans by supplying holding assets at attractive interest rates. Any interest earned by supplying funds helps offset the interest rate that users accumulate by borrowing. With this, users can access potential investment opportunities and improve portfolio liquidity.

Learn more about Defily Lending at: docs.defily.io/financial/lending